Beginning with Volatility in Emerging Markets, the narrative unfolds in a compelling and distinctive manner, drawing readers into a story that promises to be both engaging and uniquely memorable.

As we delve into the intricacies of market volatility in emerging economies, we uncover a dynamic landscape shaped by various factors and strategies that influence investment decisions and risk management.

Overview of Volatility in Emerging Markets

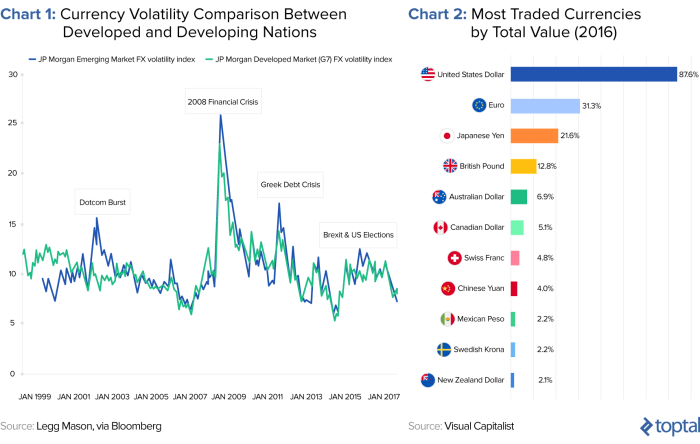

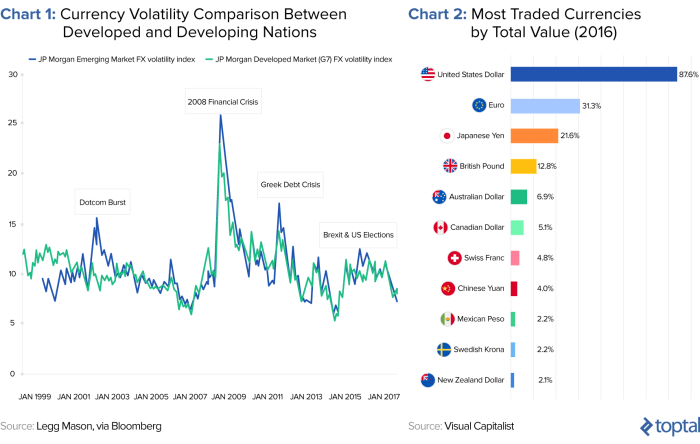

Volatility in emerging markets refers to the unpredictable and rapid changes in the prices of assets within developing economies. These fluctuations can be influenced by various factors such as political instability, economic uncertainties, currency devaluations, and market speculations.

Recent Instances of Volatility in Emerging Markets

- In 2020, the COVID-19 pandemic led to a sharp decline in emerging market stocks and currencies as investors feared the economic impact of the global crisis.

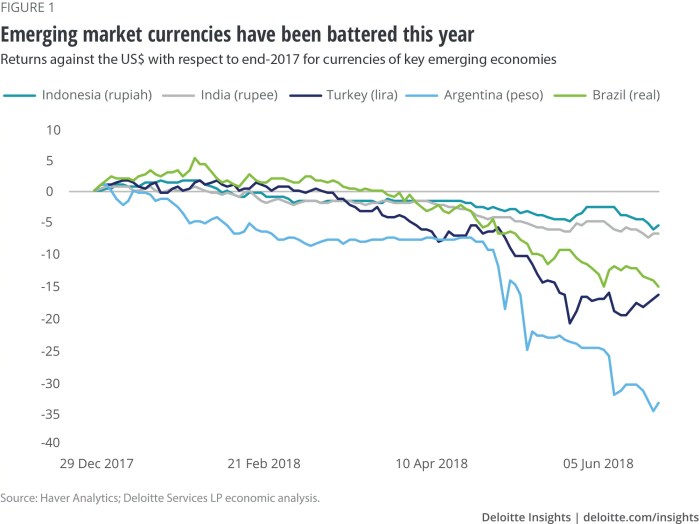

- The Turkish lira experienced significant volatility in 2018 due to concerns over the country’s economic policies and tensions with the United States.

- Argentina faced a debt crisis in 2019, causing its currency to plummet and leading to high inflation rates, showcasing the vulnerability of emerging markets to external shocks.

Impact of Volatility on Investors and Economies

- Volatility in emerging markets can create uncertainty for investors, leading to a decrease in investment and capital outflows, which can further exacerbate the economic challenges faced by these economies.

- Fluctuations in asset prices can also impact the overall stability of emerging market economies, affecting inflation rates, interest rates, and the overall growth prospects of these countries.

- Moreover, the interconnectedness of global financial markets means that volatility in emerging markets can have spillover effects on developed economies, highlighting the importance of monitoring and managing risks in these markets.

Factors Contributing to Volatility in Emerging Markets

Emerging markets are characterized by their susceptibility to various factors that can lead to increased volatility in their financial markets. Understanding these key factors is crucial for investors and policymakers to navigate these markets effectively.

Political Instability vs. Economic Factors

Political instability and economic factors are two major contributors to volatility in emerging markets. Political uncertainty, such as changes in government leadership, civil unrest, or geopolitical tensions, can significantly impact investor confidence and market stability. On the other hand, economic factors like inflation, interest rates, currency fluctuations, and trade imbalances can also create fluctuations in market performance.

Role of External Shocks

External shocks, such as global economic downturns, natural disasters, or sudden shifts in commodity prices, play a significant role in influencing volatility in emerging markets. These external factors can disrupt local economies, leading to market instability and fluctuations in asset prices. Emerging markets with strong trade dependencies or limited foreign reserves are particularly vulnerable to external shocks.

Strategies for Mitigating Risks in Volatile Emerging Markets

Investing in volatile emerging markets can offer high returns but also comes with significant risks. It is crucial for investors to implement effective risk management strategies to protect their investments and navigate through turbulent market conditions.

Risk Management Strategies for Investors in Volatile Emerging Markets

In order to mitigate risks in volatile emerging markets, investors should diversify their portfolios across different asset classes, industries, and geographical regions. This diversification helps reduce exposure to any single market or sector, spreading out the risk and potentially minimizing the impact of market downturns.Additionally, investors can consider implementing stop-loss orders to automatically sell a security when it reaches a predetermined price, limiting potential losses.

Setting clear investment goals and risk tolerance levels can also help investors make informed decisions and avoid emotional reactions to market fluctuations.

Importance of Diversification in Reducing Exposure to Market Volatility

Diversification is essential in reducing exposure to market volatility as it helps spread risk across different investments. By investing in a variety of assets that are not closely correlated, investors can protect their portfolios from being significantly impacted by the poor performance of a single investment or market.Furthermore, diversification can improve the overall risk-adjusted returns of a portfolio, as losses in one asset class may be offset by gains in another.

This strategy is particularly important in volatile emerging markets where sudden shifts in economic and political conditions can lead to unpredictable market movements.

Hedging Techniques to Mitigate Risks in Turbulent Markets

Hedging involves taking positions in assets that are negatively correlated with existing investments, thereby offsetting potential losses. Investors can use options, futures contracts, or other derivatives to hedge against downside risk in volatile markets.By employing hedging techniques, investors can protect their portfolios from adverse market movements while still benefiting from potential upside opportunities. However, it is important for investors to carefully assess the costs and benefits of hedging strategies, as they can impact overall portfolio returns and liquidity.

Market Research in Emerging Markets

Market research plays a crucial role in understanding the dynamics of emerging markets. It helps businesses gain insights into consumer behavior, market trends, competition, and regulatory environment, enabling them to make informed decisions and develop effective strategies to navigate volatile conditions.

Importance of Market Research in Understanding Emerging Markets

Market research in emerging markets helps businesses identify opportunities, assess risks, and tailor their products or services to meet the specific needs of the target audience. By collecting and analyzing data on demographics, buying patterns, preferences, and economic indicators, companies can minimize uncertainties and maximize their chances of success in these rapidly changing environments.

- Conducting surveys and focus groups to gather feedback from potential customers

- Utilizing data analytics tools to track market trends and consumer behavior

- Engaging local experts and consultants to provide insights into cultural nuances and business practices

- Monitoring social media and online platforms for real-time feedback and sentiment analysis

Challenges and Opportunities of Conducting Market Research in Emerging Markets

Market research in emerging markets presents unique challenges such as inadequate infrastructure, unreliable data sources, cultural differences, and regulatory complexities. However, it also offers opportunities for innovation, growth, and first-mover advantage for businesses willing to invest time and resources in understanding these markets.

-

Inadequate infrastructure: Limited access to technology and data collection tools can hinder the research process

-

Cultural differences: Understanding local customs, traditions, and communication styles is essential for accurate interpretation of research findings

-

Regulatory complexities: Navigating legal frameworks and compliance requirements can be daunting for foreign businesses

-

Opportunities for growth: Emerging markets often offer untapped consumer segments and high demand for innovative products or services

Impact of Market Volatility on Investment Decisions

Market volatility plays a crucial role in shaping investment decisions in emerging markets. Investors need to consider various factors such as risk tolerance, market conditions, and economic indicators before making investment choices. Let’s delve deeper into how market volatility influences these decisions.

Role of Investor Sentiment

Investor sentiment is a key factor in responding to market volatility in emerging markets. During times of high volatility, emotions can run high, leading to impulsive decisions that may not align with long-term investment goals. It’s essential for investors to maintain a rational approach and focus on fundamental analysis rather than reacting solely based on market fluctuations.

Long-Term Investment Strategies

Short-term market fluctuations can often tempt investors to deviate from their long-term investment strategies. However, it’s important to remember that volatility is a natural part of the market cycle. Long-term investment strategies should be based on thorough research, diversification, and a focus on fundamental value rather than short-term gains. By staying disciplined and avoiding knee-jerk reactions to market volatility, investors can position themselves for success in emerging markets.

In conclusion, the discussion on Volatility in Emerging Markets sheds light on the challenges and opportunities presented by market turbulence, emphasizing the importance of informed decision-making and strategic planning in navigating these volatile terrains.

Clarifying Questions

What exactly is meant by ‘volatility in emerging markets’?

Volatility in emerging markets refers to the unpredictable fluctuations in prices, values, and investor sentiment within developing economies.

How does political instability compare to economic factors in contributing to market volatility?

Political instability and economic factors both play significant roles in driving market volatility, with political events often causing short-term disruptions while economic indicators influence long-term trends.

What are some effective risk management strategies for investors in volatile emerging markets?

Investors can mitigate risks in volatile markets through diversification, hedging techniques, and staying informed about market conditions and geopolitical developments.

How does market volatility impact long-term investment strategies?

Market volatility can influence long-term investment decisions by creating opportunities for savvy investors to capitalize on short-term fluctuations or adjust their portfolios based on changing market conditions.