Embark on a journey through Market Research for Industry Analysis, exploring key aspects that shape strategic decisions and industry insights. From market analysis importance to emerging trends, this overview promises an insightful read.

Delve deeper into methodologies, market volatility, and the role of big data, uncovering how businesses navigate the ever-evolving landscape of market research.

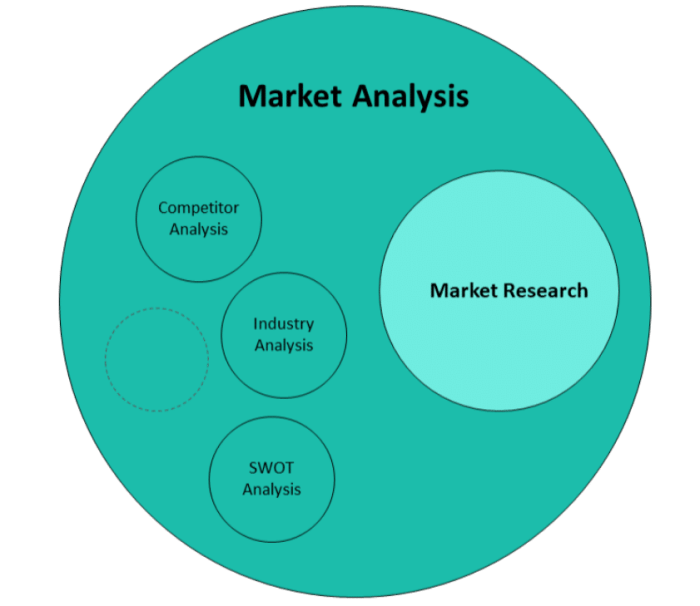

Market Analysis

Market analysis plays a crucial role in understanding industry trends and making informed decisions for businesses. By examining various market factors, businesses can gain valuable insights that help them stay competitive and adapt to changing market conditions.

Key Elements of Market Analysis

- Market size and growth potential

- Competitor analysis

- Consumer behavior and preferences

- Regulatory environment

- Technological advancements

Impact on Strategic Decision-Making

Market analysis directly impacts strategic decision-making for businesses by providing a clear understanding of market dynamics, customer needs, and competitive landscape. Armed with this information, companies can develop targeted marketing strategies, identify new opportunities, and mitigate potential risks.

Market Research Methods

Market research methods play a crucial role in providing valuable insights for industry analysis. By employing different methodologies, businesses can gain a deeper understanding of market dynamics and consumer behavior. Let’s explore the various approaches used in market research for industry analysis.

Quantitative vs. Qualitative Research

Quantitative research involves the collection and analysis of numerical data, allowing for statistical analysis and measurement of trends. Surveys, questionnaires, and data analysis tools are commonly used in quantitative research. On the other hand, qualitative research focuses on gathering non-numerical data to understand underlying motivations and opinions. Methods such as focus groups, interviews, and observations are utilized in qualitative research.

While quantitative research provides data-driven insights and measurable results, qualitative research offers in-depth understanding of consumer behavior and preferences. By combining both approaches, businesses can obtain a comprehensive view of the market landscape.

Impact of Technology

Technology has revolutionized market research methods in recent years, enabling businesses to gather and analyze data more efficiently. Online surveys, social media monitoring, and data analytics tools have streamlined the research process and provided real-time insights. Machine learning and artificial intelligence algorithms are also being leveraged to analyze large datasets and predict market trends. With the advent of technology, businesses can now reach a wider audience, collect data in real-time, and make data-driven decisions faster than ever before.

This has significantly improved the accuracy and effectiveness of market research for industry analysis.

Market Volatility

Market volatility refers to the degree of variation in prices of financial instruments or assets within a specific market over a certain period of time. In industry analysis, market volatility plays a crucial role as it impacts the overall performance and stability of businesses operating within that market. Understanding market volatility helps businesses assess risks, make informed decisions, and develop strategies to navigate uncertain market conditions.

Factors Contributing to Market Volatility

Market volatility can be influenced by various factors, including economic indicators, geopolitical events, government policies, industry trends, and investor sentiment. Different sectors may experience volatility due to sector-specific factors such as technological advancements, regulatory changes, consumer demand, competition, and supply chain disruptions. For instance, the technology sector may face volatility due to rapid innovation cycles and changing consumer preferences, while the healthcare sector may experience volatility driven by regulatory changes and drug approvals.

- Macroeconomic Indicators: Economic data such as GDP growth, inflation rates, interest rates, and unemployment levels can impact market volatility.

- Geopolitical Events: Political instability, trade wars, and global conflicts can introduce uncertainty and volatility in the market.

- Industry Trends: Technological advancements, market disruptions, and changing consumer behavior can contribute to volatility within specific sectors.

- Investor Sentiment: Market perceptions, sentiments, and behavioral biases can lead to fluctuations in asset prices.

Strategies to Mitigate Risks Associated with Market Volatility

Businesses can adopt various strategies to manage and mitigate risks associated with market volatility. These strategies include diversification of product offerings, hedging against price fluctuations, maintaining a strong financial position, monitoring market trends, and conducting scenario analysis to assess potential risks. Additionally, businesses can collaborate with industry experts, utilize risk management tools, and stay informed about market developments to make proactive decisions in response to changing market conditions.

- Diversification: Spreading investments across different asset classes, industries, and geographies can reduce the impact of volatility on overall portfolio performance.

- Hedging: Using hedging instruments such as options, futures, and derivatives can help businesses protect against unfavorable price movements.

- Financial Stability: Maintaining adequate cash reserves, managing debt levels, and improving liquidity can enhance resilience against market volatility.

- Market Monitoring: Continuously monitoring market trends, analyzing competitor activities, and staying updated on industry news can provide valuable insights for decision-making.

- Scenario Analysis: Conducting scenario analysis to simulate potential market scenarios and evaluate the impact of different risk factors can help businesses prepare for unforeseen events.

Emerging Trends in Market Research

Market research practices are constantly evolving to keep up with the changing business landscape. In today’s digital age, several emerging trends are shaping the way industry analysis is conducted. From leveraging big data and analytics to adapting to the challenges of globalization, market researchers are exploring new strategies to gain valuable insights into consumer behavior and market trends.

Big Data and Analytics

Big data and analytics play a crucial role in shaping market research strategies. By collecting and analyzing large volumes of data from various sources, companies can gain a deeper understanding of consumer preferences, behavior patterns, and market trends. This allows businesses to make more informed decisions and tailor their products or services to meet the needs of their target audience.

The use of advanced analytics tools enables market researchers to identify valuable insights and trends that may have gone unnoticed in traditional research methods.

Globalization Impact

Globalization has had a significant impact on market research methodologies. As businesses expand their operations across borders, market researchers are faced with the challenge of understanding diverse consumer markets and cultural differences. This has led to the adoption of more sophisticated research techniques that take into account the nuances of different regions and demographics. Additionally, globalization has increased the need for real-time data analysis and insights to stay competitive in a rapidly evolving global marketplace.

As we conclude our exploration of Market Research for Industry Analysis, we reflect on the dynamic nature of market trends and the critical role market research plays in shaping business strategies. Stay informed, stay ahead.

Detailed FAQs

What role does market analysis play in understanding industry trends?

Market analysis provides vital insights into consumer behavior, competitive landscapes, and emerging opportunities, allowing businesses to make informed strategic decisions.

How has technology influenced market research methods in recent years?

Technology has revolutionized market research by enabling faster data collection, advanced analytics, and increased automation, enhancing the accuracy and efficiency of insights.

What are the strategies for businesses to mitigate risks associated with market volatility?

Businesses can diversify their product portfolios, establish strong customer relationships, and implement agile marketing strategies to adapt swiftly to market fluctuations and mitigate risks effectively.

What are the implications of globalization on market research methodologies?

Globalization has expanded market boundaries, necessitating cross-cultural research approaches, increased focus on international consumer behavior, and the integration of diverse data sources to capture global market dynamics effectively.