Market Volatility Index (VIX) Explained sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Explore the nuances of VIX, from its calculation to its impact on trading strategies, in a comprehensive guide that demystifies this essential tool in the financial world.

Market Volatility Index (VIX) Overview

The Market Volatility Index (VIX), often referred to as the “fear gauge,” is a measure of expected volatility in the stock market over the next 30 days. It is calculated based on the prices of options on the S&P 500 index and is used by investors to gauge market sentiment and assess the level of risk or uncertainty in the market.

Significance of VIX in Measuring Market Volatility

The VIX plays a crucial role in measuring market volatility as it reflects investors’ expectations of future market volatility. A high VIX value indicates increased market uncertainty and potential for large price swings, while a low VIX value suggests market stability and confidence. Traders often use the VIX to make informed decisions about risk management and portfolio hedging strategies based on the perceived level of market volatility.

Calculation of the VIX

The calculation of the VIX, also known as the Fear Gauge, is a complex process that involves analyzing options pricing to determine market volatility.The methodology used to calculate the VIX is based on the prices of S&P 500 index options. Specifically, the VIX is derived from the prices of a range of near-term and next-term put and call options with different strike prices.

These options are used to create a synthetic portfolio that mimics the behavior of the S&P 500 index.Factors that influence the VIX calculation include the demand for options, the time to expiration, and the distribution of option prices. When there is high demand for options, the VIX tends to increase, indicating higher market volatility. Additionally, as the time to expiration decreases, the VIX typically rises, reflecting uncertainty and potential market swings.

Example of VIX Calculation

To compute the VIX, a weighted average of the implied volatility of options is used. This involves calculating the square root of the weighted sum of individual option prices. The VIX is expressed as a percentage and represents the expected annualized volatility of the S&P 500 index over the next 30 days.In different market scenarios, the VIX may fluctuate based on changing conditions.

For example, during periods of economic uncertainty or market downturns, the VIX tends to spike as investors seek protection through options. Conversely, in times of market stability and optimism, the VIX may decrease as volatility subsides.Overall, the VIX calculation provides valuable insight into market sentiment and helps investors gauge the level of risk and uncertainty present in the financial markets.

Interpreting VIX Levels

When it comes to interpreting VIX levels, it is crucial to understand how they reflect market sentiment and influence investor behavior.VIX levels are often used as a gauge of market volatility and investor fear. A high VIX level typically indicates increased market uncertainty and fear among investors. This can lead to higher levels of market volatility, as investors may be more hesitant to take on risk or may be looking to hedge their positions to protect against potential losses.On the other hand, low VIX levels can signal a sense of complacency or stability in the markets.

When VIX levels are low, investors may become more confident in the market’s direction and may be more willing to take on higher levels of risk. However, it is essential to note that low VIX levels can also indicate a level of complacency among investors, as they may not be adequately prepared for unexpected shifts in market conditions.

Implications of High VIX Levels

High VIX levels often result in increased market volatility and uncertainty, which can lead to sharp price swings and heightened risk aversion among investors. During periods of high VIX levels, investors may be more inclined to sell off their positions or seek out safer assets, such as government bonds or gold, to weather the storm. This can further exacerbate market turbulence and create a self-reinforcing cycle of fear and selling pressure.

It is essential for investors to remain vigilant and carefully assess their risk exposure during times of high VIX levels to avoid potential losses.

Implications of Low VIX Levels

Conversely, low VIX levels can signify a sense of calm and confidence in the markets. Investors may be more willing to take on riskier investments or increase their exposure to equities during periods of low volatility. However, it is crucial for investors to exercise caution during times of low VIX levels, as unexpected events or shifts in market sentiment can quickly lead to a spike in volatility and catch unprepared investors off guard.

While low VIX levels can offer opportunities for higher returns, investors should remain diligent and maintain a diversified portfolio to mitigate potential risks.

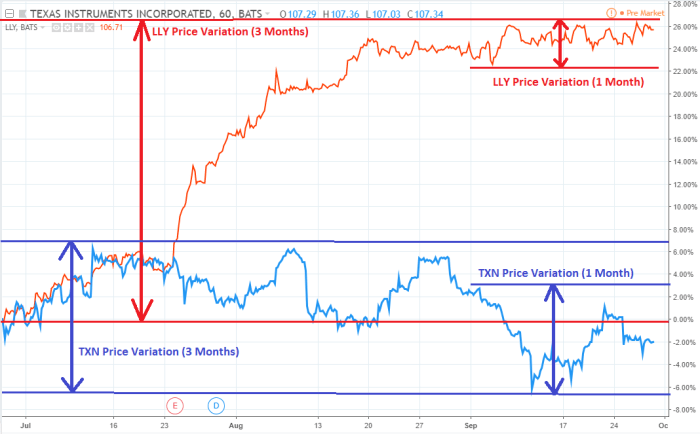

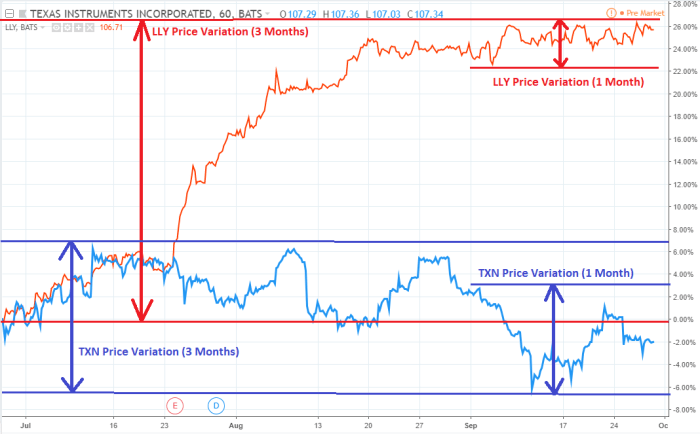

VIX vs. Market Performance

When it comes to understanding market dynamics, comparing the movement of the VIX with stock market performance is crucial. The VIX is often seen as a gauge of market sentiment and volatility, providing valuable insights into potential market trends.Historical data has shown correlations between the VIX and market trends. Typically, when the VIX is high, it indicates increased market volatility and uncertainty.

This can often coincide with a downturn in the stock market as investors become more risk-averse. On the other hand, a low VIX may signal complacency in the market and potentially precede a rally in stock prices.

Correlation Between VIX and Market Trends

- During periods of market turmoil, the VIX tends to spike as investors flock to safe-haven assets, leading to a decline in stock prices.

- Conversely, when the VIX is at low levels, it can suggest that investors are more confident in the market, leading to potential stock market rallies.

- There have been instances where the VIX has preceded major market downturns, acting as an early warning sign for investors to adjust their portfolios accordingly.

Impact of Market Volatility on Trading Strategies

When it comes to trading in the financial markets, market volatility plays a crucial role in shaping trading strategies. Traders often adjust their approaches based on the level of volatility in the market, as it can significantly impact the risk and reward of their trades. Understanding how to navigate different volatility environments is essential for successful trading.

Adapting Strategies to VIX Levels

- During periods of high volatility, traders may opt for short-term trading strategies that capitalize on quick price movements. Techniques such as scalping or day trading can be more suitable in these conditions.

- Conversely, in low volatility environments, traders might focus on trend-following strategies that aim to capture gradual price movements over a longer period. Swing trading or position trading can be more effective in such scenarios.

Role of VIX in Risk Management

- The VIX can be used as a valuable tool in risk management for traders and investors. A high VIX level indicates increased market uncertainty and potential for larger price swings, prompting traders to adjust their position sizes and risk exposure accordingly.

- On the other hand, a low VIX level suggests a more stable market environment with lower expected volatility. Traders may choose to increase their position sizes during these times but remain cautious of sudden spikes in volatility.

Market Research and VIX

Market research plays a crucial role in understanding market dynamics and making informed investment decisions. Incorporating VIX data into market research analysis provides valuable insights into market sentiment and volatility.

Incorporating VIX Data for Analysis

- The VIX is often used as a measure of market volatility, reflecting investors’ expectations of future market fluctuations.

- Market research analysts utilize VIX data to assess the level of fear or complacency in the market, helping them gauge investor sentiment.

- By analyzing VIX trends alongside other market indicators, researchers can identify potential shifts in market behavior and sentiment.

Relevance of VIX in Forecasting Market Trends

- The VIX is considered a leading indicator, providing insights into potential market direction and trends.

- Market research reports often incorporate VIX analysis to forecast market trends and anticipate possible market movements.

- Changes in VIX levels can signal shifts in market sentiment, helping researchers anticipate market reversals or continued trends.

Use of VIX in Developing Market Research Reports and Strategies

- Market research reports frequently include VIX analysis to provide a comprehensive view of market conditions and risks.

- Integrating VIX data into market research strategies allows analysts to make more informed decisions based on volatility expectations.

- VIX data is essential for risk management and developing effective trading strategies that account for market volatility.

Delve deeper into the world of market volatility with Market Volatility Index (VIX) Explained, a revealing look at how VIX influences market sentiment, trading strategies, and more.

FAQ Corner

What is the Market Volatility Index (VIX)?

The Market Volatility Index (VIX) is a measure of market volatility derived from the prices of S&P 500 index options.

How is the VIX calculated?

The VIX is calculated using a formula that takes into account the implied volatility of a range of S&P 500 index options.

What do different VIX levels indicate?

Low VIX levels may suggest market stability, while high VIX levels can indicate increased market volatility and fear among investors.