Sector analysis in stock markets sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality. From understanding different sectors to exploring the impact of external factors, this overview delves deep into the world of stock market analysis.

As we navigate through the methods, factors, and market research related to sector analysis, investors will gain valuable insights on making informed decisions.

Overview of Sector Analysis in Stock Markets

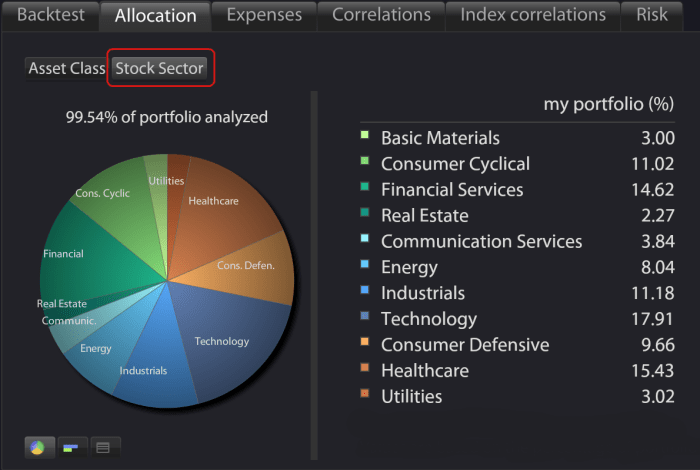

Sector analysis in stock markets refers to the process of evaluating and analyzing different sectors of the economy to identify investment opportunities. By focusing on specific sectors, investors can gain insights into the performance and trends of companies operating within those sectors. This analysis helps investors make informed decisions about where to allocate their funds based on the outlook for each sector.

Examples of Different Sectors Analyzed in the Stock Market

- Technology Sector: Companies involved in the development and manufacturing of technology products and services, such as Apple, Microsoft, and Google.

- Healthcare Sector: Companies engaged in providing healthcare products, services, and pharmaceuticals, such as Johnson & Johnson, Pfizer, and UnitedHealth Group.

- Financial Sector: Companies in the banking, insurance, and financial services industries, such as JPMorgan Chase, Bank of America, and Visa.

- Consumer Goods Sector: Companies that produce and distribute consumer goods, such as Procter & Gamble, Coca-Cola, and Nike.

Importance of Sector Analysis for Investors

Sector analysis is crucial for investors as it allows them to diversify their portfolios effectively, reduce risk exposure, and capitalize on emerging trends and opportunities. By understanding the performance of different sectors, investors can make strategic investment decisions that align with their financial goals and risk tolerance. Additionally, sector analysis helps investors stay informed about the broader economic landscape and make adjustments to their portfolios accordingly.

Methods for Conducting Sector Analysis

When conducting sector analysis, investors typically follow a series of steps to evaluate and compare different sectors within the stock market. This process helps them identify opportunities and risks associated with specific industries.

Comparing Fundamental Analysis and Technical Analysis

Before diving into sector analysis, it’s essential to understand the differences between fundamental analysis and technical analysis:

- Fundamental Analysis:

- Focuses on evaluating the financial health and performance of companies within a specific sector.

- Examines factors such as revenue, earnings, growth potential, and market trends to determine the intrinsic value of a stock.

- Long-term investors often rely on fundamental analysis to make investment decisions.

- Technical Analysis:

- Utilizes historical price charts and trading volume data to analyze stock price movements.

- Identifies patterns and trends to forecast future price movements within a sector.

- Short-term traders often use technical analysis to time their trades and capitalize on short-term price fluctuations.

Using Sector Analysis for Informed Investment Decisions

Investors can leverage sector analysis to make informed investment decisions by:

- Identifying Sector Trends:

- Monitoring macroeconomic indicators and industry-specific news to identify emerging trends within a sector.

- Understanding the impact of external factors like government policies, global events, and technological advancements on sector performance.

- Comparing Sector Performance:

- Comparing the financial metrics and stock performance of companies within the same sector to identify potential investment opportunities.

- Assessing the growth prospects, competitive landscape, and regulatory environment of different sectors to allocate capital effectively.

- Diversifying Portfolio:

- Utilizing sector analysis to diversify investment portfolios across different industries and minimize risk exposure.

- Balancing high-growth sectors with defensive sectors to create a well-rounded portfolio that can withstand market fluctuations.

Factors Impacting Sector Analysis

When conducting sector analysis in the stock market, it is important to consider various external factors that can significantly influence the performance of different sectors. These factors play a crucial role in determining the overall health and growth potential of specific industry segments.

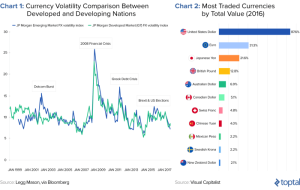

Economic Indicators

- Economic indicators such as GDP growth, interest rates, and inflation have a direct impact on sector analysis. For example, high GDP growth rates often indicate a healthy economy, leading to increased consumer spending and overall sector growth. On the other hand, rising interest rates can negatively affect sectors like real estate and utilities, as borrowing costs increase.

- Interest rates set by central banks can influence borrowing costs for companies within specific sectors, impacting their profitability and growth prospects. Sectors that are highly sensitive to interest rate changes include financial services, housing, and consumer goods.

- Inflation is another critical economic indicator that can impact sector performance. High inflation rates can erode consumer purchasing power, affecting sectors like retail, hospitality, and consumer staples.

Geopolitical Events

- Geopolitical events such as wars, trade disputes, and political instability can create market volatility and impact sector performance. For example, trade tensions between countries can disrupt global supply chains, affecting sectors like technology, manufacturing, and transportation.

- Political instability in key regions can lead to uncertainty in the market, causing investors to be cautious and affecting sectors like energy, defense, and infrastructure. Geopolitical events can introduce systemic risk to sectors that are closely tied to international relations.

Market Analysis and Research in Relation to Sector Analysis

Market analysis and research in the context of the stock market involve evaluating various factors that affect the overall performance of the market. This includes examining economic indicators, company financials, market trends, and investor sentiment to make informed investment decisions.Market analysis complements sector analysis by providing a broader perspective on the overall market conditions and trends. While sector analysis focuses on specific industries or sectors, market analysis looks at the market as a whole, including factors that impact all sectors.

By combining both analyses, investors can better understand the dynamics of the market and identify potential investment opportunities.

Examples of Market Research Techniques

- Technical Analysis: This involves studying historical price and volume data to identify patterns and trends in stock prices. Technical analysts use charts and indicators to predict future price movements.

- Fundamental Analysis: This method involves evaluating a company’s financial statements, management team, competitive position, and industry trends to determine its intrinsic value. Fundamental analysts believe that stock prices will eventually reflect the true value of a company.

- Sentiment Analysis: This involves gauging the mood and attitude of investors towards a particular stock or the market as a whole. Sentiment analysis can help identify potential market trends based on investor behavior and emotions.

In conclusion, sector analysis in stock markets is a vital tool for investors seeking to navigate the complexities of the stock market. By understanding sector performance, conducting thorough research, and staying informed about market trends, investors can enhance their investment strategies and optimize their returns.

Helpful Answers

How does sector analysis help investors?

Sector analysis helps investors by providing insights into the performance of different sectors, allowing them to make informed investment decisions based on trends and data.

What is the difference between fundamental and technical analysis in sector analysis?

Fundamental analysis focuses on assessing the intrinsic value of a stock, while technical analysis uses historical price trends and chart patterns to predict future price movements. In sector analysis, investors may use both methods to gain a comprehensive view.

How do economic indicators impact sector analysis?

Economic indicators like GDP growth, interest rates, and inflation can influence sector performance by affecting consumer spending, borrowing costs, and overall market sentiment. Understanding these factors is crucial in sector analysis.

Why is market research important in relation to sector analysis?

Market research complements sector analysis by providing additional insights into broader market trends, investor behavior, and competitive landscape. By combining both analyses, investors can make more strategic investment decisions.