Embark on a journey to understand the intricacies of volatility in financial markets. This introduction sets the stage for a deep dive into the world of market fluctuations and their impact on investments.

Explore the various types of market volatility, measurement metrics, strategies for managing volatility, and the profound influence of market volatility on investments.

Introduction to Volatility

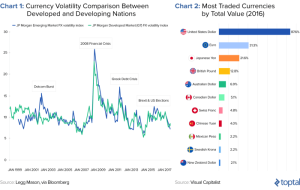

Market volatility refers to the degree of variation in the price of a financial instrument or security over time. It is a crucial concept in financial markets as it reflects the uncertainty and risk associated with investments. Understanding volatility is essential for investors and traders to make informed decisions and manage their portfolios effectively.Factors contributing to market volatility include economic indicators, geopolitical events, corporate earnings reports, interest rates, and market sentiment.

Sudden changes in any of these factors can lead to sharp fluctuations in prices, causing volatility to spike.Recent volatile market events include the COVID-19 pandemic, which triggered a global market sell-off in early 2020. The uncertainty surrounding the virus and its economic impacts led to extreme volatility across various asset classes. Another example is the US-China trade war, which created uncertainty in the markets and resulted in increased volatility in stock prices and exchange rates.

Impact of Volatility on Investors

Market volatility can have significant impacts on investors, affecting their portfolios and investment decisions. Here are some key points to consider:

- Increased Risk: Higher volatility implies a greater level of risk for investors, as prices can fluctuate widely in a short period.

- Opportunities for Gains: Volatile markets can also present opportunities for investors to profit from price movements through active trading or strategic investments.

- Emotional Response: Volatility can evoke emotional responses in investors, leading to irrational decision-making based on fear or greed.

- Diversification: Proper diversification of investments can help mitigate the impact of volatility on a portfolio by spreading risk across different assets.

Types of Market Volatility

Market volatility can take on different forms, each with its own characteristics and implications for trading strategies. The main types of market volatility include historical, implied, and realized volatility.

Historical Volatility

Historical volatility is a measure of past price movements of a financial instrument over a specific period. It is typically calculated using statistical methods such as standard deviation. Traders use historical volatility to gauge the level of risk associated with an asset. For example, a stock with high historical volatility may be riskier but could also offer higher potential returns.

Implied Volatility

Implied volatility, on the other hand, reflects the market’s expectations for future price movements of an asset. It is derived from options prices and represents the market’s consensus on the potential magnitude of future fluctuations. Traders often use implied volatility to assess the market’s sentiment and make informed decisions on trading strategies. For instance, a sharp increase in implied volatility could indicate heightened uncertainty in the market.

Realized Volatility

Realized volatility measures the actual price fluctuations of an asset over a specific period. It is calculated based on historical price data and provides insights into the true extent of market movements. Traders use realized volatility to evaluate the accuracy of their forecasts and adjust their risk management strategies accordingly. For example, if realized volatility exceeds expectations, traders may need to reevaluate their risk exposure and adjust their positions accordingly.Overall, understanding the nuances of historical, implied, and realized volatility is crucial for traders to develop effective strategies and navigate the dynamic nature of financial markets.

Measuring Volatility

When it comes to measuring volatility in financial markets, there are several common metrics that investors rely on to assess the level of risk and uncertainty in the market. Some of the key metrics used include standard deviation, beta, and the VIX index.

Standard Deviation

Standard deviation is a statistical measure that helps investors understand the amount of variation or dispersion of a set of values from its average. In the context of market volatility, standard deviation is used to gauge how much the price of a security is expected to deviate from its historical average price. A higher standard deviation indicates higher volatility and greater potential risk.

Beta

Beta is a measure of a security’s volatility in relation to the overall market. A beta of 1 indicates that the security’s price moves in line with the market, while a beta greater than 1 indicates higher volatility compared to the market. On the other hand, a beta of less than 1 suggests lower volatility compared to the market. Investors use beta to assess the level of risk associated with a particular security.

VIX Index

The VIX index, also known as the “fear gauge,” measures market expectations of near-term volatility conveyed by S&P 500 stock index options. A higher VIX value indicates higher expected volatility and uncertainty in the market, while a lower value suggests lower expected volatility. Investors often use the VIX index as an indicator of market sentiment and potential shifts in market direction.

Strategies for Managing Volatility

When it comes to managing volatility in financial markets, investors often employ various strategies to either hedge against or take advantage of market fluctuations. Diversification plays a key role in mitigating volatility risk, spreading investments across different asset classes to reduce overall portfolio risk. Successful investors have demonstrated the importance of navigating volatile markets with a well-thought-out approach.

Hedging Strategies

One common strategy used by investors to hedge against volatility is through the use of options contracts. By purchasing put options, investors can protect their portfolios from potential downside risk during periods of market turbulence. Additionally, some investors utilize inverse exchange-traded funds (ETFs) to profit from market downturns, as these funds aim to move in the opposite direction of the underlying index.

Role of Diversification

Diversification is a fundamental strategy for managing volatility risk. By spreading investments across a mix of asset classes, industries, and geographic regions, investors can reduce the impact of market fluctuations on their overall portfolio. This approach helps to balance out potential losses in one area with gains in another, providing a more stable investment outlook.

Case Studies in Navigating Volatile Markets

Successful investors have showcased their ability to navigate volatile markets through strategic decision-making and risk management. For example, during the 2008 financial crisis, Warren Buffett took advantage of market turmoil to invest in undervalued companies like Goldman Sachs and Bank of America, reaping significant returns in the long run. Similarly, George Soros famously bet against the British pound in 1992, profiting from the currency’s devaluation and earning billions in the process.

Impact of Market Volatility on Investments

Market volatility can significantly impact various asset classes, including stocks, bonds, and commodities. During periods of high volatility, the prices of these assets can experience sharp fluctuations, leading to both opportunities and risks for investors.

Stocks

Stocks are particularly sensitive to market volatility due to their inherent risk-return characteristics. When market volatility increases, stock prices tend to become more erratic, making it challenging for investors to predict price movements. Investor sentiment plays a crucial role in driving stock prices during volatile market conditions.

Bonds

Bonds, on the other hand, are generally considered safer investments compared to stocks. However, bond prices can also be affected by market volatility, especially in the case of corporate bonds or high-yield bonds. During periods of heightened volatility, investors may seek the relative safety of government bonds, leading to changes in bond prices.

Commodities

Commodities, such as gold, oil, and agricultural products, are known for their price volatility. Market volatility can have a significant impact on commodity prices, driven by factors such as supply and demand dynamics, geopolitical events, and economic indicators. Investors often turn to commodities as a hedge against inflation or market uncertainty during volatile times.

Investor Behavior

Market volatility can trigger various behavioral biases among investors, such as panic selling, herd mentality, or overconfidence. Understanding these behavioral patterns is crucial for making informed investment decisions during turbulent market conditions. Maintaining a disciplined approach, focusing on long-term goals, and diversifying investments can help mitigate the impact of market volatility on investment portfolios.

Informed Investment Decisions

To navigate through volatile market conditions, investors should conduct thorough research, stay informed about market trends, and consult with financial advisors. Diversification across asset classes, sectors, and geographies can help reduce risk exposure. Implementing risk management strategies, such as setting stop-loss orders or utilizing options contracts, can also protect investments during periods of high volatility.

Market Research and Volatility

Market research plays a crucial role in understanding and predicting market volatility. By analyzing various factors that influence market movements, researchers can gain valuable insights into potential trends and fluctuations in the market.

Methodologies in Market Research

- Quantitative Analysis: Utilizing statistical models and mathematical formulas to evaluate historical data and identify patterns that may indicate future market behavior.

- Qualitative Analysis: Examining non-numerical data such as news, events, and investor sentiment to assess the market’s overall sentiment and potential impact on volatility.

- Technical Analysis: Studying price charts and trading volumes to identify trends and potential price movements based on historical patterns.

Data Analysis and Risk Management

- Utilizing Market Research Tools: Advanced software and platforms can help analyze vast amounts of data quickly and efficiently, providing valuable insights into market trends and potential volatility.

- Risk Assessment: By conducting thorough market research, investors can identify potential risks associated with market volatility and develop strategies to mitigate these risks effectively.

- Scenario Analysis: Using historical data and market research findings to simulate different scenarios and assess how various factors may impact market volatility, allowing investors to make informed decisions.

In conclusion, grasping the concept of volatility in financial markets is crucial for making informed investment decisions and navigating through turbulent market conditions with confidence.

User Queries

What factors contribute to market volatility?

Market volatility can be influenced by various factors such as economic indicators, geopolitical events, and changes in investor sentiment.

How can investors hedge against market volatility?

Investors can hedge against market volatility by diversifying their portfolios, using options and futures contracts, and employing risk management techniques.